Content

Learn to get paid faster in accounts receivable and save money in accounts payable with a clearer understanding of net 30 and early payment discounts, such as 2/10 net 30. Net 30 is a term used on invoices to describe the deadline for payment of an invoice. Net 30 means that payment is due within 30 days of when the invoice is received.

If you’d like to negotiate a 2/10 net 30 discount with your vendors or sellers, this is how it works. Smaller businesses and freelancers can’t afford to wait until this works itself out and can end up with more problems in the long run. If you are a more experienced freelancer, then this may not be an issue. If you have wiggle room or cash to spare, then the risk may be worth the reward.

What does “net 30 EOM” mean?

Despite offering generous net terms, expect that not every client will pay you on time. This can lead to cash flow problems and negatively impact your bottom line. In some instances, it may not be in the best interest of your business’s cash flow to pay your bills early.

Indy Invoices makes it easier than ever to send invoices that look great and help you get paid fast. After all, net terms offer short-term credit, so there’s no need to give that credit to someone who doesn’t pay on time. This offer will also give you a competitive advantage, and new customers may want to take advantage of this offer. Ensure the percent discount is enough to cover your service and remain competitive. If 30 days is too long for you, then you could consider net 10 or net 15.

Lost resources due to back-end office processes

When you’re starved for sales, it can be tempting to loosen up the rules you have in place to extend credit to your clients (also known as your business credit policy)—don’t. The amount of sales credit you extend to your clients and for how long should depend on your business needs and how generous you can afford to be. When you offer someone net 30 terms, you’re offering them the chance to pay you up to 30 calendar days after you bill them for a good or service. In the U.K., the invoicing term “net 30, end of the month” is also common.

However, late payments still happen on a regular basis for small to medium businesses in every industry. Many small businesses like the idea of offering net 30 terms but get caught up in the drawbacks. If you fall into this bracket, invoice factoring may be your ideal solution.

Where to Put Net 30 in the Invoice

The 30 day period includes the time products spend in transit to the end-consumer. Even if you have enough cash on hand, if you only rely on a few large customers, you may run into cash flow problems if just one payment is late. If you have a large number of clients, however, you’ll be in a much better position to compensate for multiple late payments. For businesses that have a product that is hard to distinguish from competitors’ products, offering flexible payment terms can help them stand out from the crowd.

If you want to go the extra mile with net 30, you could offer an early payment discount that makes the customer happy and gets you paid sooner. For example, you can give a 3% discount to clients who pay within 10 days of the invoice date. https://www.bookstime.com/ If your company is already experiencing cash flow issues, then you may not want to offer a 30-day payment plan. Many freelancers, especially beginners, rely on upfront payments to pay their bills and keep their businesses going.

Cash Flow Issues

This can have a devastating impact on a business, especially if it is a large and time-consuming project. I like to expect the best from people, but we all know some clients enter agreements with no intention of paying off invoices. We all hope to spot red flags and weed out those scammers instead of working for them, but there’s always a possibility you won’t receive full payment. This net 30 payment terms can create cash flow problems for your business and mean delinquencies on your part and a ton of stress until the client pays. Suppliers or vendors will formulate their early payment discount offering according to their objectives. If they are keen to encourage as many early payments as possible to increase the velocity of their inflows, they might offer a higher discount amount.

- You may be asked to pay your invoices immediately when you are a new customer or new business.

- The length of your financing agreement is typically dependent on your relationship with the business offering payment terms, as well as your ability to negotiate.

- Essentially, a seller who sets payment terms of net 30 is extending 30 days of credit to the buyer after goods or services have been delivered.

- Gross is the total amount before that said dedication, the net payments definition is the amount afterward.

Net 30 terms are advantageous for sellers because they strike a balance between being generous and conservative. 30 days is plenty of time for a customer to approve, process and send a payment, but not so long that a payment may be delayed too long. Net 30 payment terms are among the most common invoice payment terms, but whether they’re ideal for you depends on your business, goals, and other factors. On this page, you’ll learn what net 30 terms are, get an overview of similar terms, and explore alternatives.

Invoices contain the date of sale, goods or services purchased, payment terms and conditions, etc. The payment terms refer to the conditions under which a buyer has to pay-off the full value of the invoice. Net 30 payment terms on an invoice means the customer has 30 days to pay the full balance of the invoice. On the contrary, small businesses looking to grow their customer base may not fancy net 30 due to the cash flow risk it poses.

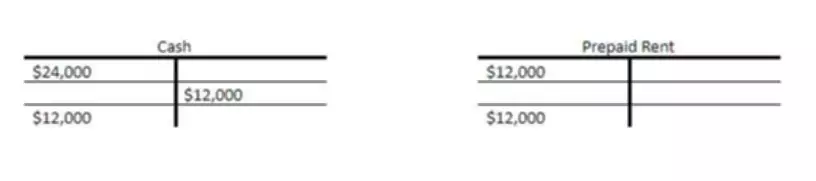

For example, if you want to offer a 2% discount to customers who pay early, you can change the billing term to 2/10 net 30. The net 30 period generally begins on the day the invoice is delivered to the customer–the invoice date. So if goods were delivered on a Monday, but the invoice wasn’t sent until the following Wednesday, the customer has 30 calendar days from that Wednesday to send payment. When a new client signs up and sees these terms, they’ll understand that you’re serious about getting paid on time.